We’ve tried a lot of things to help us tackle our family budget over the years.

And although we know a lot of people who advocate for some formal or traditional approach, we prefer to use the same process that has helped us (bitterly) in all of our Monday meetings: mutual respect, clear goals, and honest feedback.

You’ll have to decide what works best for you, but if you’re looking for honest feedback and advice from a couple that knows what it’s like to be married and how hard it can be to honestly decide how to handle your money – read on!

This post is all about how to family budget for 2023.

Need to Skip Ahead?

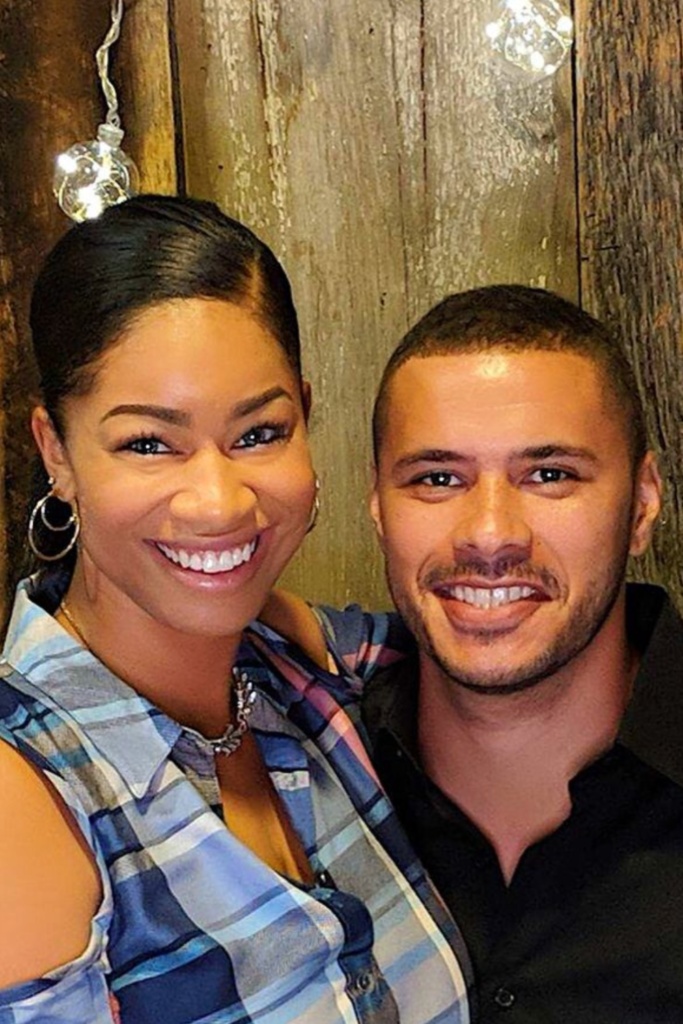

My husband leads our Monday Meetings, as family budgeting is his bread and butter (and he is today’s guest post).

Are your marriage and finances struggling?

Do you find that your finances are still being managed separately by each of you rather than being discussed as a team?

Do you feel like you’re not on the same page in regard to what money issues need to be addressed?

If so, it might be time for Monday Meeting!

Five years ago, my wife Victoria and I decided that we were going to tackle our family budget together.

We needed to talk about how much money we were bringing in, how much we were spending, and how much we had left over at the end of each month.

We also started writing down our goals for each month as well as discussing our financial goals as a couple.

Let’s start with why I am writing this.

I have been self-studying finance and investing since high school.

Sharing what I have learned with friends and those that will listen is one of my passions.

I am an engineer in Silicon Valley (remotely) and enjoy helping people make career shifts toward technology.

We are on a similar journey as the rest of you, and while we may have an unorthodox approach to money and finance, it is more practical than what you hear from Dave Ramsey or Robert Kiyosaki.

I have nothing against those guys, just that their advice is either too watered down or too far-fetched to apply in most situations people find themselves in.

Here is the path we have embarked on, so feel free to tag along, watch from the side, or laugh.

Either way, we are taking action for what is ahead, and you should also.

Step 1: Figure out what you don’t want in your future.

This is what we call an anti-vision.

Coming at it from this direction has some advantages for your brain.

In a Monday Meeting, it’s easier for us to get specific on things we don’t want for our future.

Think: credit card debt, the stress of living paycheck to paycheck, being unable to travel, not learning that language or that instrument, etc.

Take 30-1hr and write down everything you don’t want when determining how to family budget for this year.

Looking at my examples, it doesn’t have to be all financially motivated.

Our goal is to not focus on materialistic like mansions, millions of dollars, and fast cars.

Those things can be afforded only after building systems and habits to create the ability to achieve those things.

Focus on how to help people solve a problem because getting rich is a byproduct.

Step 2: Figure out the worst-case scenario.

Now that you have your “anti-vision,” let’s use that to determine the worst-case scenario(s) if we do nothing to prevent what we don’t want in life.

Is it depression, poor relationship with your spouse, homelessness, or maybe it is just not living your life to the fullest potential?

Do your best to scare yourself but be realistic about things that could happen when planning how to family budget for 2023.

If you have kids, think about their future and how that could be affected if your anti-vision comes true.

Think about your spouse and your relationship with one another.

Lastly, look ahead to when you are of retirement age.

What are things you will regret or be prevented from accomplishing due to the anti-vision?

Okay, I think you get the point.

Let’s move on to step three.

Step 3: Identify the things you need to do to fend off the anti-vision

What are the actual steps you need to take now to get ahead of these worst-case scenarios?

In order to understand how to family budget, you need to understand your family’s cash flow.

You can think of family as a high-tech startup business.

A startup’s financial success is primarily driven by how well they manage its cash flow (what comes in – what goes out).

In our Monday meeting, get a handle on what you have left over every month after all your spending and categorize it.

I know that sounds scary and time-consuming, well it doesn’t have to be because there are apps that can help.

Our recommendation is you use Monarch.

Monarch is how we track our cash flow and net worth.

We have used all the apps that do this, and Monarch is our favorite.

What have you learned?

Is your cash flow positive or negative?

If you are positive, are you maximizing your spending, or did you find out you spent $1000 in pizza orders last month?

Is cash flow negative because of poor spending habits, or are you struggling month to month with bare necessities?

Once you have your answer time for Step 4 of how to family budget for 2023.

Step 4: Get brutally honest with your situation.

Okay, if you are in the camp of barely scraping by each month, I only have one thing to recommend.

When discussing how to family budget, you must figure out how to increase your income.

It’s unlikely you have a spending problem; you just found yourself in a low-paying field.

Yes, I get that you could make more than the average household and barely scrap by because you racked up debt due to poor habits, have expensive cars, or a home you can’t afford.

If that is you, well, I have the same advice.

Make more money and reduce your outflow.

I know that is hard to hear, but you’re not going to penny-pinch your way out or invest your way out of this situation.

This brings us to Step 5 on how to family budget in your Monday Meeting.

Step 5: Plan of attack

I don’t have stock or crypto picks for you, but I have a mental model for keeping your financial situation healthy and on a path to building wealth.

If you are paycheck to paycheck, you need to look for ways to increase your income. sounds obvious, but that’s what you need.

Look for a second job or get into deliveries or something.

Try to get a few months of cash set aside as a buffer fund.

Do not skip this step.

If you are in a dead-end job, try to develop skills that pay well but don’t require a degree.

This is where you spend any extra leftover money.

Build skills!

Try to get into tech, sales, and or finance.

Your income is your most powerful wealth-building tool, so put all your efforts there and bring to a six-figure income stream.

Okay, now that you are on a different income band with the career shift or extra income you’re bringing in with side jobs, build your cash buffer to 3-6 months.

After doing so, I recommend optimizing cash flow and reducing your outgoing spending.

Do this by paying off fixed expenses like credit card debt, cars, personal loans, and student loans.

Delete the stock market from your mind for now unless you are getting a 401k match.

Get that free money and get back to debt payoff asap.

Now that you are primarily debt-free, everything except your house.

If you own one, here is what I would do next.

Put the majority of your effort into building a business on the side of your career.

Keep building skills to get promotions, but all your extra money should go towards building additional income streams.

This is where we are unorthodox with our finances.

While we have money in the market and alternatives, the majority now goes into buildings additional streams of income (preferably online businesses).

You only need to get it right once with a company that will pay you 10x more than trying to play the stock market.

If you can’t invest at least 75-100k per year or stomach a 50% drawdown in your investments, delete the stock market from your mind.

I’m sure you have heard the average market return rate is 8 or 9% before inflation and before taxes, so your real return is not that attractive, honestly.

Also, who is to say that rate is guaranteed for the foreseeable future?

No one knows, but I do know that we can create value and offer that to people or businesses that will pay.

If you made it here, congrats!

Your side businesses are generating 2x your salary after taxes.

What to do next?

We’ll know you have my permission to pile into the market.

I know I talked trash, but where else can you put the money?

You could do real estate, but we don’t want to be landlords outside of a single paid-off rental.

Too much of a headache.

So for us, that leaves the market, alternatives like art and real estate crowdfunding.

You should have one year of cash as a buffer and have some choices.

Pay off home, give generously (should be showing in every step, though, to be honest).

Quit your job and go all in on your new income streams or continue what you’re doing.

No wrong answer, but look towards your anti-vision, and that will be your guide.

This post was all about how to family budget for your Monday Meeting.

Monday meetings are a crucial tool for married couples looking to budget as a team effectively.

By regularly setting aside time to review your finances and make necessary adjustments, you can ensure that you are on track to achieve your financial goals and build a solid financial foundation for your future together.

Don’t let the fear of budgeting hold you back – take the time to sit down and plan out your finances, and you’ll be amazed at the progress you can make.

So don’t forget to mark your calendars for those Monday Meetings – they might be the key to your financial success.

If you found this helpful, make sure to check out more Marriage and Money content; and follow us on Instagram to see Do You Even Mom moments in real-time.

Other posts you may like:

- How to Be Successful First Time Landlords With No Experience

- Improve Your Marriage with A Joint Bank Account

- 9 Dating Mistakes You’re Probably Making Right Now